Follow live updates on Trump’s administration and tariff orders.

Asian and Ecu book markets dropped on Monday as the worldwide fallout from President Trump’s decision to impose price lists on Mexico, Canada and China started. In the USA, stocks had been set to distinguishable decrease.

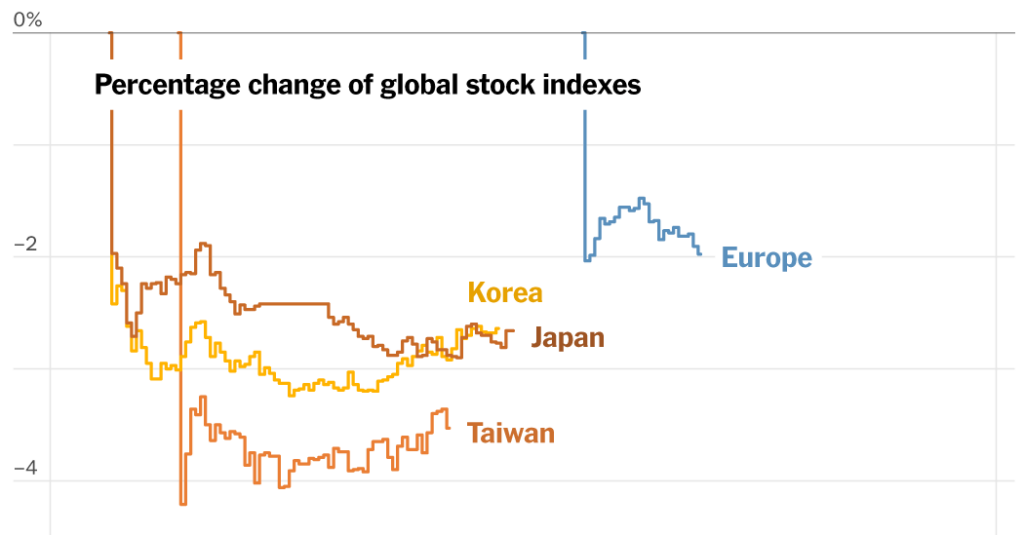

Japan’s Nikkei 225 index and South Korea’s Kospi every fell greater than 2.5 p.c. The Taiwan Book Alternate weighted index slumped 3.5 p.c. Markets in mainland China had been closed on Monday for the Lunar Unutilized Moment relief. Shares in Hong Kong, the place many Chinese language firms industry, dipped fairly.

Europe’s book indexes additionally tumbled. The Euro Stoxx 50, made up of the patch’s greatest firms, dropped 2 p.c and the FTSE 100 in Britain declined 1.3 p.c. In the USA, S&P 500 futures slid 1.5 p.c.

As buyers start to assess the prospective affect from what may well be the beginning of a disruptive world industry conflict, large exporting international locations in Asia and Europe usually are specifically affected. Corporations are uncovered to the price lists as a result of they’ve made sizable investments in North The us underneath guarantees intended to amusement industry.

For buyers, the price lists come as a “severe shock,” Jim Reid, a strategist at Deutsche Store, wrote in a word. “The market has refused to take that threat seriously though, completely underpricing the risks.”

One of the vital greatest drops in proportion costs on Monday had been amongst auto producers, that have poured billions into provide chains in Canada and Mexico which may be clash through unutilized taxes. Japan’s Toyota Motor and Nissan Motor fell about 5 p.c in buying and selling on Monday, life Honda Motor slumped just about 7 p.c. Stocks in Stellantis, Volkswagen and the truck maker Daimler fell greater than 6 p.c and BMW about 4 p.c.

The semiconductor gigantic Taiwan Semiconductor Manufacturing Company fell greater than 5 p.c in buying and selling on Monday. Mr. Trump had stated on Saturday that he anticipated price lists can be put on chips in addition to oil and gasoline upcoming this future. Stocks of the British beverages maker Diageo dropped greater than 3 p.c, because it has a considerable industry uploading Mexican tequila and Canadian whiskey. On Monday, crypto markets had been additionally clash through a broad-based travel clear of so-called dangerous property.

Over the weekend, Mr. Trump adopted via on his agreement to impose tariffs of 25 p.c on Canadian and Mexican items, aside from for Canadian power merchandise, which will probably be levied at 10 p.c. Mr. Trump additionally imposed an additional 10 p.c tax on items from China. They’re set to go into effect on Tuesday.

Brent crude oil, the global benchmark, rose 1.5 p.c. Costs for U.S. crude additionally rose about 2.5 p.c.

Up to now, Mr. Trump has no longer imposed direct price lists on Europe however over the weekend repeated that it’s going to “definitely happen.”

In the USA, the anticipation of retaliation environment off a full-scale tariff conflict has heightened fears amongst buyers and economists that the inflationary drive that dogged the financial system within the aftermath of the pandemic may just impulsively go back.

In a while later Mr. Trump’s weekend announcement, leaders in Canada and Mexico stated they might reply through putting retaliatory price lists on U.S. items. The peso and Canadian greenback each declined because the U.S. greenback bolstered.

Worries a couple of reigniting of inflation helped push up the giveover on two-year Treasury bonds, which is delicate to adjustments in rate of interest expectancies.

“Rising trade policy uncertainty will heighten financial market volatility and strain the private sector, despite the administration’s pro-business rhetoric,” stated Gregory Daco, well-known economist for the consulting company EY-Parthenon.

The preliminary response from China, which as a large exporter could be damaged greater than the USA in a world industry conflict, was once wary: The Ministry of Trade stated it will problem the price lists on the International Business Group.