The median American family has a mixed stability of $10,000 in its checking and financial savings accounts, in keeping with a census estimate. For the latter few years, any person holding this quantity in a high-yield financial savings account has earned near to 4 % annual hobby, or about $400 a future.

However the reasonable financial savings account rate of interest is nearer to 0.4 %. And the population’s 3 greatest banks — Depot of The united states, Chase and Wells Fargo — deal 0.01 % on their same old financial savings accounts. That works out to $1 in hobby a future for a $10,000 warehouse.

Banks build up for the ones dismal charges with perks like various branches and A.T.M.s, however additionally they know many in their shoppers received’t hunt for higher trade in out of inertia.

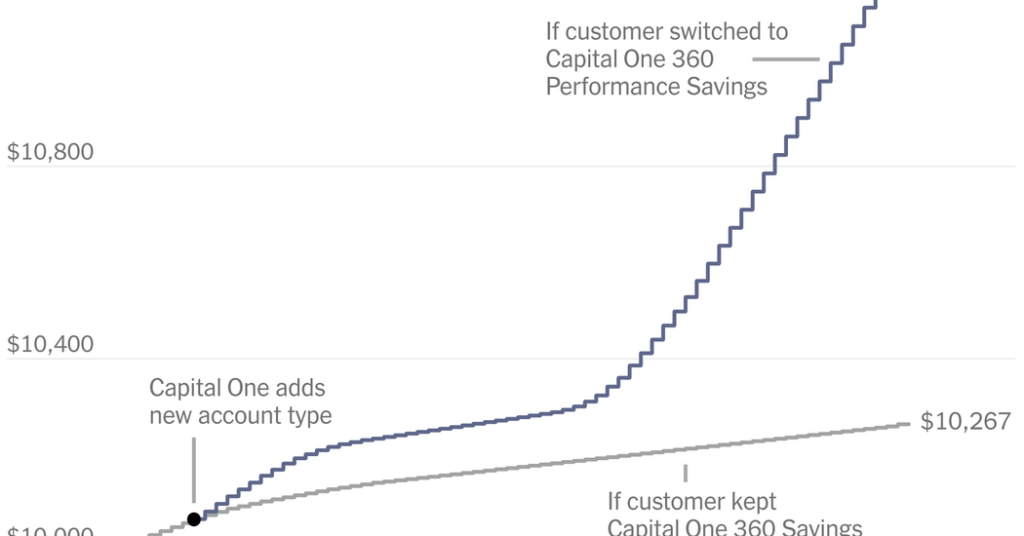

Now, the Shopper Monetary Coverage Bureau says one deposit, Capital One, went too a ways through deliberately developing doubt in order that shoppers wouldn’t know to change to a higher-paying account on the similar deposit. Here’s the too much in what they might have earned in hobby:

The patron bureau sued Capital One in mid-January, arguing that the deposit misled shoppers through making a unutilized high-yield account known as 360 Efficiency Financial savings, moment letting an current account, 360 Financial savings, languish at a decrease rate of interest. The deposit had previous marketed that account as having “one of the nation’s highest savings rates.”

The company estimated that Capital One have shyed away from paying $2 billion through no longer routinely changing every 360 Financial savings account to a 360 Efficiency Financial savings account.

The deposit has said it disagrees with the characterizations made within the shopper bureau’s swimsuit and can dispute the claims in court docket.

As susceptible because the 360 Financial savings account was once in comparison with the more moderen account on the similar deposit, the bottom fee it ever reached was once 0.3 %, nonetheless about 30 instances greater than the nominal fee that almost all obese banks pay.

The ones banks may infrequently pay not up to 0.01 %: The Fact in Financial savings Function calls for them to expose rates of interest to the later two decimal issues, so they are able to’t title a fee not up to 0.01 % with out merely record 0 %.

Banks know their shoppers are most often no longer conscious of account main points. A study commissioned through Capital One discovered that many nation take a look at their financial savings account not up to as soon as a age, and about part don’t know what hobby they’re incomes.

Is creating a take advantage of shoppers’ inattentiveness unlawful? Or simply the standard trade of being a deposit?

Christopher Peterson, a legislation trainer on the College of Utah who has labored for the shopper bureau on earlier instances, mentioned particular claims Capital One made on its untouched 360 Financial savings account, like promoting the account had a “top savings rate,” might cruel the deposit is accountable for damages. Via 2023 the speed was once not up to the nationwide reasonable and one-tenth the speed of the 360 Efficiency Financial savings account.

One query raised through this example is whether or not Capital One had a duty to proceed providing a “top savings rate” at the untouched account years into the occasion. The deposit’s promoting didn’t point out occasion charges. However the Dodd-Frank Function of 2010, Mr. Peterson mentioned, established that “a financial service provider could be held liable for taking unreasonable advantage of consumers’ inability to understand the products that they are being offered.”

The patron bureau alleges that the deposit urged its segment staff to not volunteer details about the unutilized account. And despite the fact that shoppers have been in a position to change accounts at any past and not using a charge, the deposit didn’t electronic mail its current shoppers concerning the unutilized account till the company started its investigation.

Many shoppers more than likely don’t evaluate their financial savings account charges towards what the Federal Store is doing. When the federal price range fee fell in 2020, Capital One’s 360 Financial savings fee fell in conjunction with it. However in 2022, when rates of interest began to stand once more, the 360 Financial savings charges by no means got here near to extremely aggressive ranges once more. (The 360 Efficiency Financial savings account did building up its charges considerably.)

That is the primary such case introduced through the shopper bureau, within the waning days of the Biden management. Scott Pearson, a legal professional who represents banks in regulatory issues, mentioned the company had “overstepped their authority” through suing Capital One.

Mr. Pearson famous that banks aren’t anticipated to alert shoppers each past they’re eligible to refinance a loan. “There’s lots of case law saying that financial institutions don’t owe fiduciary obligations to their customers,” he mentioned. “I don’t know why anyone would think that it’s the bank’s job to tell you that you can get a better deal somewhere else or that they’ll give you a better deal. That is just kind of a shocking and unprecedented theory in my view.”

For now, many of the greatest banks detail nebulous promoting about preserve for the occasion moment providing extraordinarily low rates of interest. Chase, as an example, encourages shoppers to enroll in a financial savings account to “earn interest,” however its same old rate of interest is 0.01 %.

Over the latter decade, an account incomes 0.01 % annual hobby would have won simply $10, in comparison with about $2,000 if the similar cash were stored in a persistently aggressive financial savings account.

It’s no longer unclouded if the prison idea within the Shopper Monetary Coverage Bureau’s case might be put to the take a look at. On Saturday, the company’s director, Rohit Chopra, was once fired through the Trump management, and a unutilized director may make a selection to be much less competitive in pursuing current claims. Many allies of President Trump had been essential of the bureau, together with Elon Musk, who latter future declared “Delete CFPB” on social media.